Beware of unnecessary complexity

Generally speaking, investors face two choices: being a part-owner of businesses around the world (stocks), or lending money to companies and governments (bonds). Funds are simply combinations of stocks and/or bonds in a mix that meets the mandate of the respective fund.

There is a finite number of listed stocks and available bonds, yet – interestingly - there are more stock funds than there are stocks themselves! The investment industry is increasingly competitive and the number of funds available continues to rise – it is evident that having a sensible process for selecting what funds should be included in an investor’s portfolio is key for investing success.

Cutting through the complexity and noise is a task that our firm’s Investment Committee does not take lightly – a comprehensive whole-of-market fund screening process takes place on a regular basis. This process ensures that we remain confident that the funds recommended to you are ‘best-in-class’, offering the best chance of a successful investing experience.

Some investors assume that more funds must be better. Managing the risk exposure of a portfolio with 20 or more funds can be challenging for any investor. It can feel reassuring, as if adding extra funds automatically deepens diversification. The reality, however, is that the underlying stocks and bonds within the funds held are what provide the returns (and risk) to investors – therefore holding multiple funds may simply adjust the weights of what is already held, or even double up on exactly the same stock and bond exposures[1].

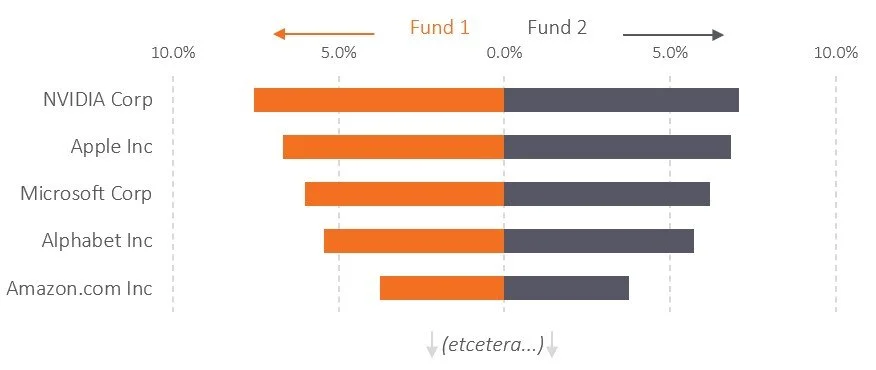

This may be intentional, and additive, but it can also create unnecessary complexity and duplication. Take, for example, two funds capturing the returns of US stock markets. Some may naively hold both assuming that diversification is improved, though if one offers better alignment with one’s goals (e.g. lower cost, longer track record, meets performance parameters closer) then it raises the question of why this is not selected alone.

Figure 1: Largest five holdings of two US stock market index tracking funds

Source: Fidelity Index US Fund (left), Legal & General US Index Trust (right). For example purposes only. Not a recommendation.

Clearly, splitting an allocation between both funds adds little-to-no value to investing outcomes, as the holdings are virtually the same.

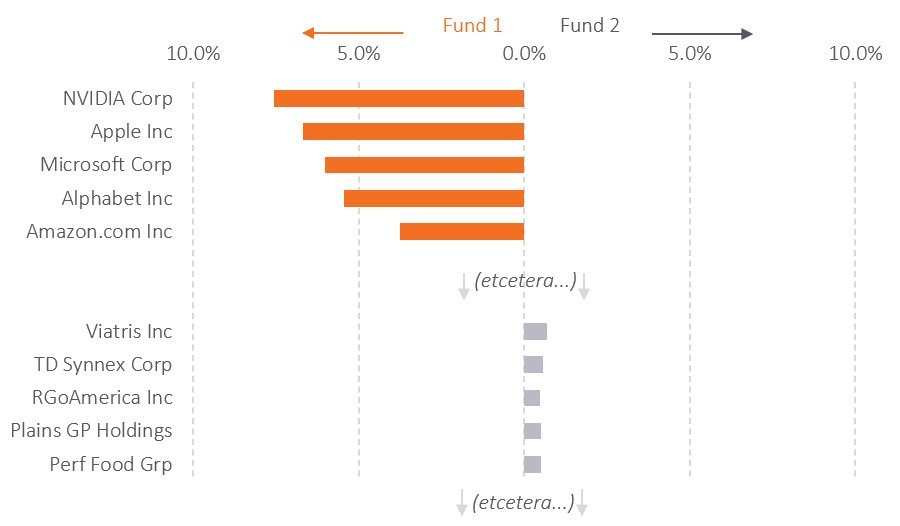

Sometimes, holding several funds can be additive in some circumstances. For example, an investor looking to capture the returns of small cap or value companies – in order to increase expected returns - might do so with a few funds that adjust the weights to underlying stocks to provide a ‘tilted’ exposure to these desired attributes.

Figure 2: Largest five holdings of US stock market index tracking fund, and small cap value fund. Source: Fidelity Index US Fund (left), SPDR MSCI USA Small Cap Val (right). For example purposes only. Not a recommendation.

Investors seeking a sensibly structured portfolio for the long term are not required to own an unnecessary number of funds to do so. Simplicity does not mean a lack of sophistication. Choosing the best funds for their designated role – and monitoring them regularly through time - is key to investing success. For a modern, forward thinking financial planning business, this responsibility sits within the remit of a firms Investment Committee and form part of the regular review process of the investment solution financial planners recommend to their clients.

Beware of unnecessary complexity, disguised as diversification.

“Everything should be made as simple as possible, but not simpler”

Albert Einstein

If you are unclear as to the process followed by your current advisory or wealth management firm, not receiving regular investment reviews or feel overwhelmed by wordy, complicated information you receive from your adviser, perhaps its time for a change. Feel free to get in touch using the button below for a second opinion.

References

[1] Note that investor assets sit in a ringfenced custodial account – not on a fund manager’s balance sheet. Splitting allocations between managers on this basis should not be a concern, ceteris paribus.