The Riches Report Blog

Beware of unnecessary complexity

Generally speaking, investors face two choices: being a part-owner of businesses around the world (stocks), or lending money to companies and governments (bonds). Funds are simply combinations of stocks and/or bonds in a mix that meets the mandate of the respective fund.

There is a finite number of listed stocks and available bonds, yet – interestingly - there are more stock funds than there are stocks themselves! The investment industry is increasingly competitive and the number of funds available continues to rise – it is evident that having a sensible process for selecting what funds should be included in an investor’s portfolio is key for investing success.

The Courage to Feel Left Out

You've probably heard a few stories of investors who made a fortune with a single investment decision. The neighbour who bought Amazon early and saw massive returns, or the colleague who invested in AI startups and is now talking about early retirement.

When I hear stories like these, it's natural to feel like you’re being left out. However, for every success story you hear, there are countless others you don't. Families who chased the next big thing, only to watch significant capital disappear when they backed the wrong company or the hype faded.

Every new technology and industry will lead to incredible success stories for some investors. However, for long-term investors to risk the family financial fortress on isolated bets is irresponsible.

Retirement Reimagined

Retirement as we know it is barely 150 years old. Otto von Bismarck introduced the world's first state pension in Germany in 1889, setting the retirement age at 70, an age that only a minority of the population actually reached.

The concept was simple: work until you could no longer physically do so, and then society would care for you in your final years.

That world no longer exists. The forces reshaping how we live and work are so fundamental that the retirement of the future is unlikely to resemble the retirement of the past. The question isn't whether retirement will change, but how quickly we can adapt our thinking to match this new reality.

For the first time in history, we have the tools and longevity to completely reimagine what the later decades of life could look like.

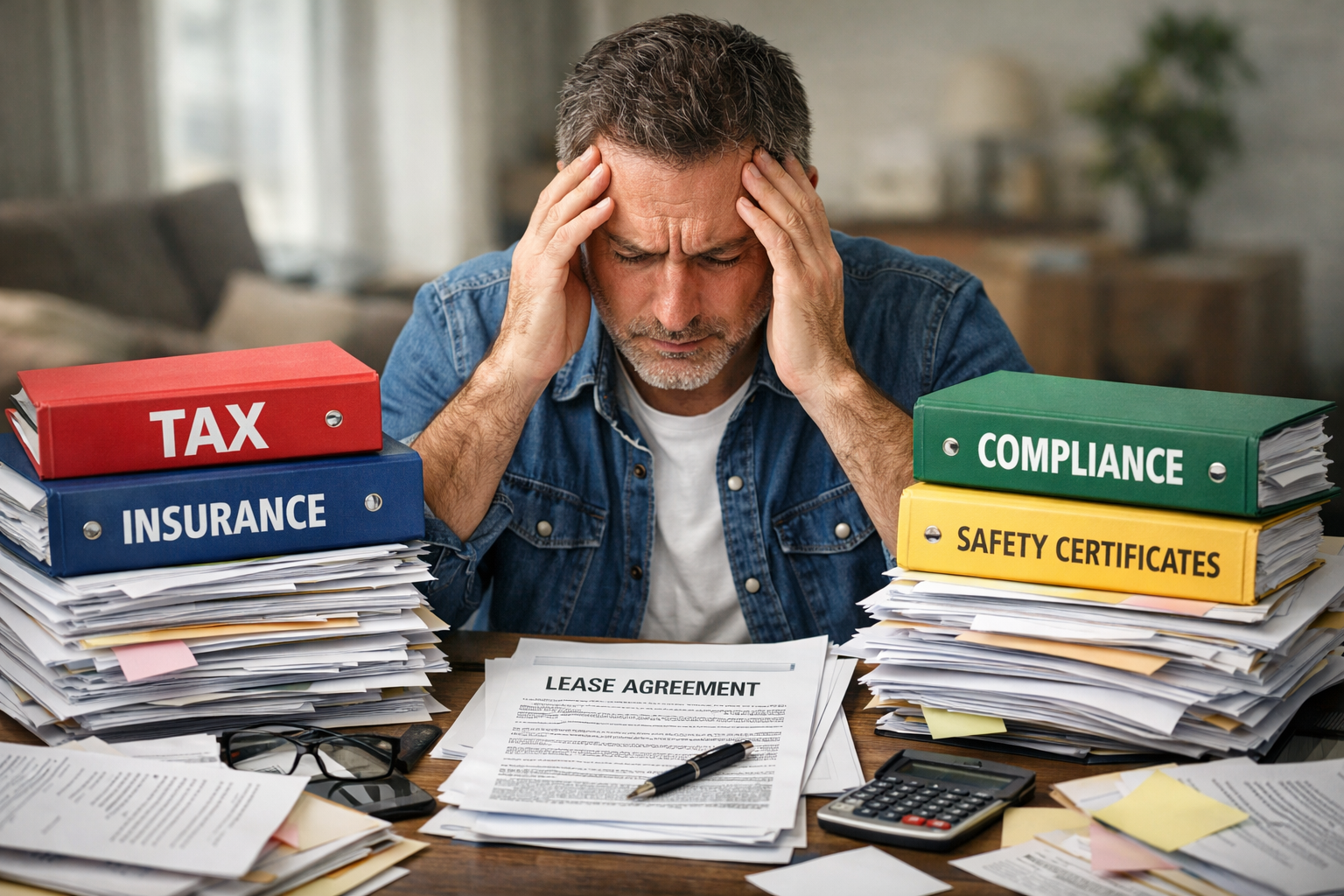

The Overlooked Hassles of Owning Property

When building wealth for retirement, we often focus solely on the price tag of investments. However, many overlook a crucial insight that the true cost of owning assets extends far beyond the initial purchase price.

2026: Looking backwards and forwards

Being an investor can be emotionally challenging. Even after a run of positive years, it is entirely natural to worry that some of those gains may be given back. Then again, this is regularly a feature of a long-term investor’s journey, though no such guarantees exist.

As the calendar turns, it is once again the season for bold predictions and confident outlooks. Experience suggests that such forecasts are best treated lightly. Markets incorporate known information very quickly, and prices only move meaningfully when something new and unexpected arrives. The future, by definition, is unpredictable. A sensible forecast for the year ahead therefore remains unchanged: markets will go up, down or sideways.

Hiding in Plain Sight: Private Asset Exposure Through Public Equities

Investors may face hurdles to direct investing in private capital markets, including limited transparency and liquidity as well as increased complexity and costs. But most investors are already getting exposure to private assets through their public investments, even without directly facing those frictions.

The reason: Public firms invest in private ones all the time, so investing in public firms already means an allocation to private.

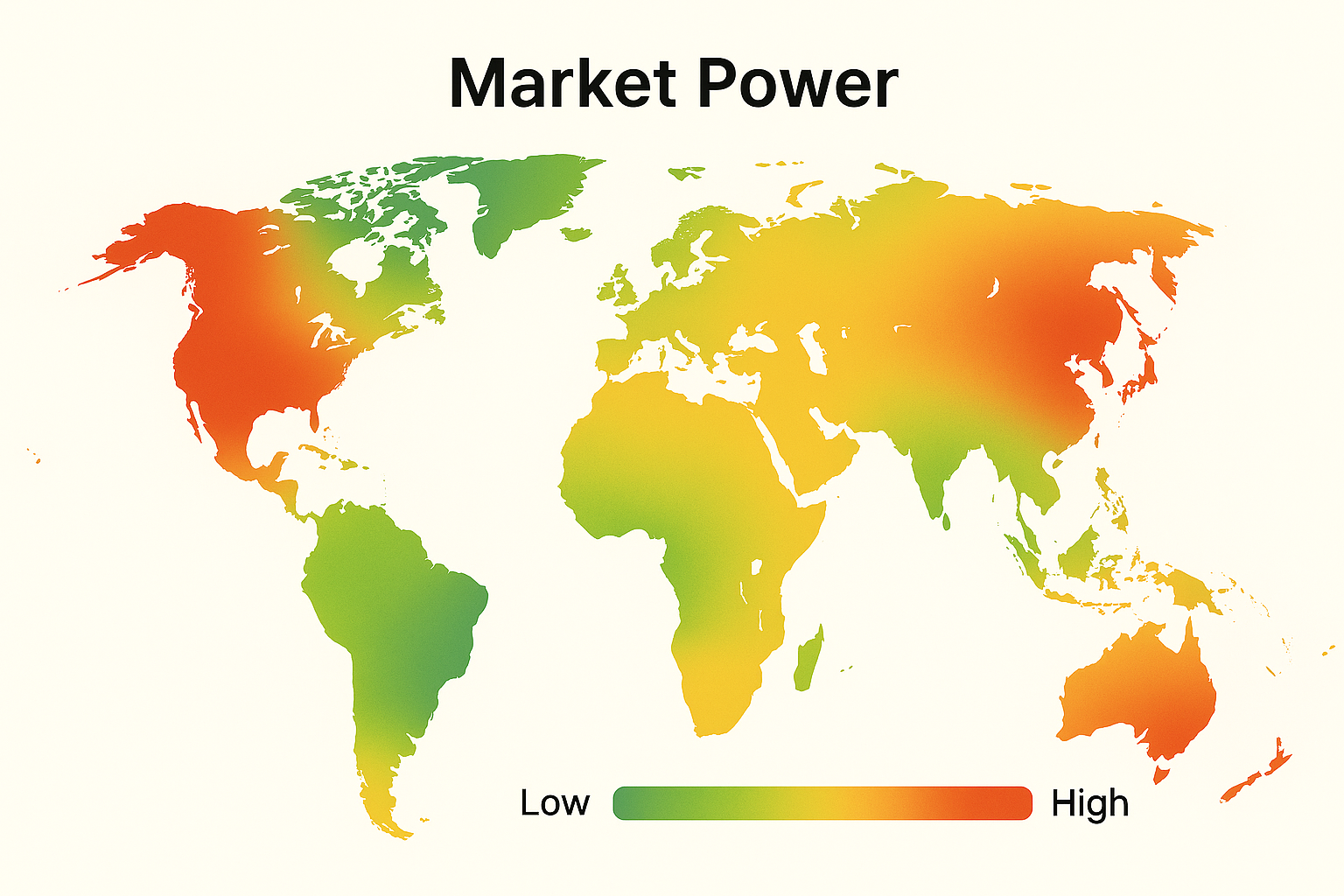

Market Concentration: What's Really Going On

If you've been following financial news lately, you've probably seen the headlines warning that the top 10 stocks now make up a larger share of major stock market indices than ever before. Most of these are technology and AI-driven companies, and if these giants stumble, the thinking goes, so will your portfolio.

It's a reasonable concern that professional advisers take seriously, but before rushing to make changes, it's worth examining what's actually happening beneath the surface.

Get Your Finances in Shape for the New Year

The start of a new year is the perfect time to hit the reset button—not just on your health and fitness, but on your finances too. Just like a good workout routine, financial fitness requires consistency, discipline, and a clear plan. Here’s how you can get your money in shape for the year ahead.

Future-Proof Your Pension: 3 Strategies Every Saver Needs Now

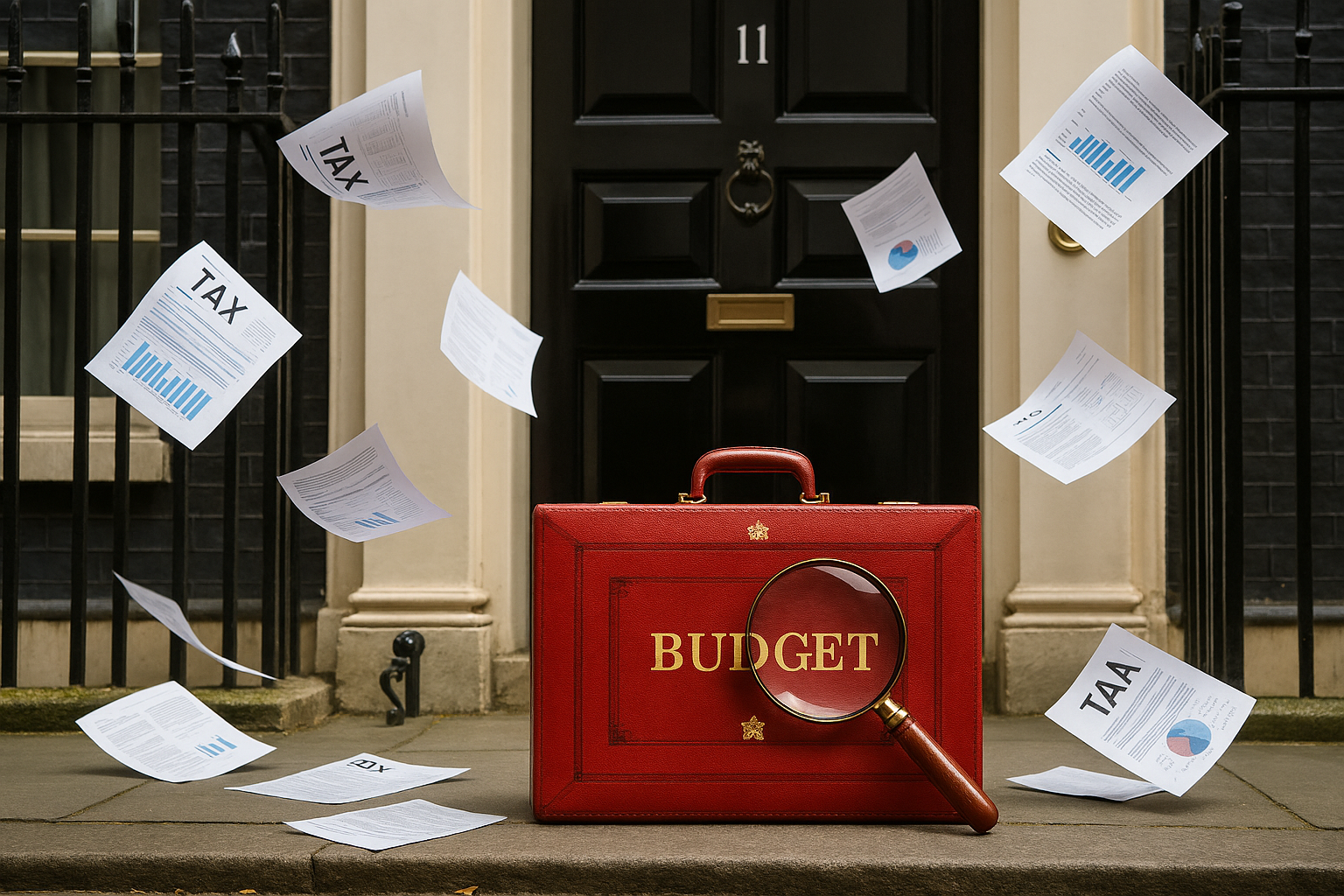

It’s no secret: when a new Budget lands, pension savers often feel the impact. In her latest Autumn Budget, Chancellor Rachel Reeves introduced a cap on salary‑sacrifice pension contributions—only the first £2,000 of employee savings will be free from National Insurance from April 2029. For the average UK earner (£39,039/year), this change could reduce take-home pay by around £112 annually if you're contributing around £200 a month through salary sacrifice.

But all’s not lost. Here is an offset to the bite—and potentially save up to £5,000 by 2030.

Navigating the 2025 UK Budget: Key Takeaways for Advisers and Clients

The recent UK budget, delivered by Chancellor Angela Reeves, was widely anticipated to bring sweeping changes. Instead, it landed as a relatively benign update—thanks to a surprise £16 billion windfall in the Office for Budget Responsibility (OBR) forecast, driven by higher wage growth and easing inflation. This unexpected fiscal headroom allowed the government to introduce welfare reforms and a series of targeted tax measures, with significant implications for individuals and business owners alike.

The balancing act

When it comes to investing, few decisions carry more weight than how you allocate your portfolio between stocks and bonds. The chart here illustrates why this choice is so critical. It shows the best, worst and average annual returns for eleven portfolios ranging from 100% bonds to 100% stocks from 1979 to 2025.

What the 2025 Budget Means for Pension Salary Sacrifice

The Autumn Budget 2025 brings a significant change to how pension contributions via salary sacrifice are treated. Right now, both employers and employees save on National Insurance Contributions (NICs) by using these schemes. However, starting 6 April 2029, this will change—NIC relief on pension salary sacrifice will be capped at £2,000 per year.

Currency risk through a long-term lens

One of the recurring themes in financial media this year has been the US dollar. After decades of strength, the dollar has depreciated against major currencies so far in 2025 - GBP, EUR, JPY, AUD, CHF, for example - prompting speculation about whether this signals the beginning of the end for its status as the global reserve currency. For globally diversified investors, this raises an important question: what could US dollar depreciation mean for long-term returns?

Budget 2025

After much hype, testing of the water “leaks” and media speculation, the Chancellor of the Exchequer, Rachel Reeves has now delivered the 2025 Budget.

For those so inclined, the full budget report can be found on the Treasury Website but for those who prefer their information in a more digestible format here is a summary of the budget, including the top 5 personal finance impacts.

Market crises through a long-term lens

During good times in markets, headlines can cause investors to wonder whether such highs signal an impending downturn or poor future returns. However, history suggests that this fear, whilst common, is often misplaced.

Double double toil and trouble

The financial media and market commentators persist with scaremongering and speculation. An AI ‘bubble’, the future of cryptocurrency and Bitcoin, government debt levels, ongoing trade wars and other geopolitical tensions dominate headlines. In general, this is nothing new. It is a feature of capital markets and the noise that surrounds them.

Tilt, don’t tinker

It’s easy to be unsettled when the same names seem to dominate every performance table. The U.S. weight in global indices is high at ~65%, technology looms large at ~30%, and the biggest companies feel all‑important – the top ten largest stocks now account for around ~25% of the global market. It can feel like the same story on repeat.

Avoiding the lure of past performance

Each day, month and year brings a fresh wave of predictions about which markets, sectors, or asset classes will outperform. Financial headlines continue to highlight the latest themes - whether it’s the rise of AI-driven companies, the growing adoption of cryptocurrencies, or the apparent resurgence of gold as a safe haven asset. Despite the persuasive narratives, investors should remain cautious about reorienting their portfolios based solely on these forecasts. As history has shown, economies and markets are inherently unpredictable.

Pensions Tax Shake-Up? What Might Be Coming in the Next Budget

As the UK edges closer to its next fiscal budget announcement, speculation is mounting over possible changes to pensions tax policy. Former pensions minister Steve Webb has weighed in, offering insights that could have significant implications for retirees and financial planners alike.

Is your investment glass half full or half empty?

We live increasingly in a world that often feels full of doom and gloom, amplified by the endless news cycle, echoed in social media comments, and exacerbated by a tendency to doomscroll on our mobiles. This geopolitical, economic and social noise risks become deafening and unsettling. What will Trump do or say next? Will the West be able to contain Putin’s imperialistic ambitions? Are taxes going to rise? Is the economy heading for a slump?