Double double toil and trouble

The financial media and market commentators persist with scaremongering and speculation. An AI ‘bubble’, the future of cryptocurrency and Bitcoin, government debt levels, ongoing trade wars and other geopolitical tensions dominate headlines. In general, this is nothing new. It is a feature of capital markets and the noise that surrounds them.

At the end of the day, a buyer and a seller come together to agree the price based on the information they have available and how they process this information – with enough participants this information gets baked into market prices. Said differently, if all participants thought there was a market bubble, it would already have ‘popped’.

Technically, a true believer in ‘efficient’ markets will deny that bubbles exist – any price changes result in changes in the perceived underlying risks and expected cashflows. An efficient market is one where today’s prices reflect all known information, such that any participant cannot know something that the market already does not. Market prices are always, therefore, fair and justified.

On the opposite side of the coin, a behaviourist will prefer the argument that sentiment towards markets ebbs and flows through time, and drives prices accordingly.

In reality, both are just models.

Evidence supports an approach to act as if markets are effective enough at pricing information, such that building an investment proposition on the opposite belief does not give an investor the best chance of a successful investing experience.

One might have sympathy for arguments that excitement and ‘FOMO’ can creep into investor choices, perhaps distorting prices. There exists the risk that many investors do not fully understand the risks inherent in stock markets and could be stung if momentum changes course sharply - which it can, and has done in the past.

An investor then faces the temptation to do something on the back of a belief that prices are unjustifiably elevated. It is, however, clear from the evidence that few, if any, possess the ability to act on and profit from this changing behaviour reliably.

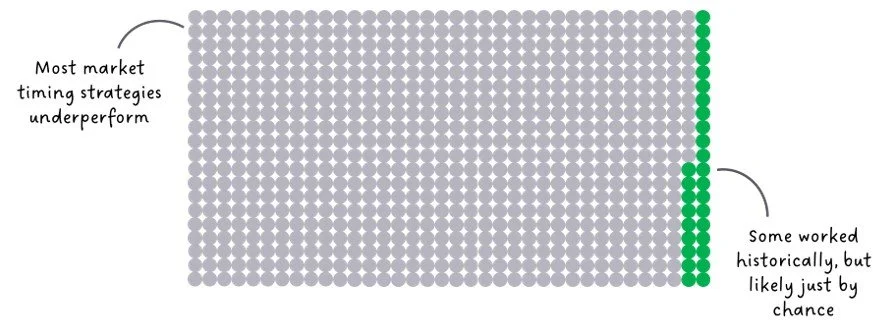

Recent research examined 720 market timing strategies across equity market, size, value, and profitability premiums in various regions. Only 30 showed initial promise, and even those were highly sensitive to time periods and construction methods. Without rigorous testing, it’s easy to mistake noise for a signal. Sadly, the ‘elixir’ remains elusive.

Figure 1: Success of simulated market timing strategies | Data source: Another Look at Timing the Equity Premiums. Dai W, Dong A. Dimensional Fund Advisers - Research (2023). Graphic: Albion Strategic Consulting.

The future is uncertain, with many plausible scenarios and a wide range of views. Fortunately, investors who trust in broadly efficient markets can rely on the collective intelligence of participants. This vast web of risks and probabilities is distilled into a single figure: the price.

It is worth remembering that every decision to exit an asset class requires a subsequent decision on when to re-enter.

As John C. Bogle, founder of Vanguard, famously said:

The idea that a bell rings to signal when investors should get into or out of the stock market is simply not credible... I don't even know anybody who knows anybody who has done it successfully and consistently.

The cost of getting it wrong – whether through emotional decisions or misplaced confidence in a ‘system’ - can be high. The world may well be in ‘bubble’ territory. Equally, it may not. Only with hindsight will any investor know with any degree of confidence.

Stay the course.