The balancing act

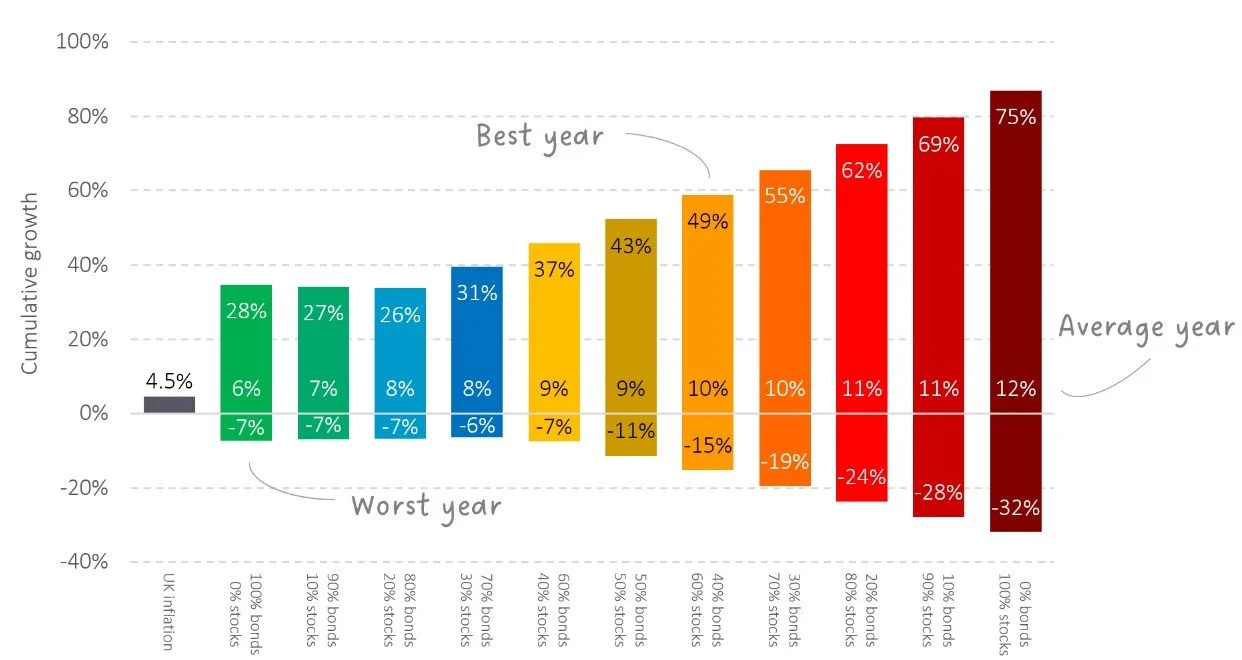

When it comes to investing, few decisions carry more weight than how you allocate your portfolio between stocks and bonds. The chart below illustrates why this choice is so critical. It shows the best, worst and average annual returns for eleven portfolios ranging from 100% bonds to 100% stocks from 1979 to 2025.

Figure 1: Best, worst and average annual return for different stock and bond mixes | Source: Albion Strategic Consulting. https://smartersuccess.net/indices. See endnote.

The data tell a story. Portfolios with more stocks have delivered higher highs and lower lows. A portfolio invested entirely in stocks achieved a best year of 75% but endured a worst year of -32%. By contrast, a portfolio invested entirely in bonds saw a best year of 28% and a worst year of -7%. Average annual returns also rise steadily with stock exposure, from 6% p.a. for an all-bond portfolio to 12% p.a. for an all-stock one.

Over the same period, UK inflation averaged around 4.5% per year demonstrating the risk of taking on ‘too little’ risk for investors. This represents a strong historical period for bonds as they materially outpaced inflation, but it is not always so easy - the recent decade has not been so kind. Owning too bond-heavy portfolios over longer periods may put one’s financial goals at risk, given the lower expected returns bond portfolios carry.

On the flipside, taking too much risk brings its own challenges. Sharp, short-term drawdowns can trigger panic selling at precisely the wrong time, causing investors to miss recoveries and putting the financial plan at risk in a different way. Stocks may also take several years to recover, meaning bonds are required to meet short-term spending needs. Striking the right balance is essential.

Determining your stock and bond allocation is not a one-time exercise. It should reflect the need to take risk to achieve your goals, your financial capacity to withstand losses, behavioural traits such as risk tolerance, your experience in investing, and your personal preferences and circumstances.

Working with a financial adviser on an ongoing basis can help navigate these challenges and ensure you remain invested in a portfolio that gives you the best chance of success. If you are keen to learn more, click the link below.