US ‘exceptionalism’ - resilient reality or risky illusion?

For more than a decade, the U.S. stock market has outperformed nearly every other major equity market. This outperformance has been driven in large part by a handful of dominant technology firms such as Meta, Google, and Microsoft. The so-called ‘Magnificent Seven’ accounted for just under 7% of the total value of U.S. stocks at the end of 2014, but by the end of 2024, that figure had risen to 28%[1]. In 2024 alone, the ‘Mag 7’ delivered a return of 48%, while the remaining 493 companies in the S&P 500 returned approximately 16%. In contrast, global markets excluding the U.S. returned only about 5% (in USD terms)[2]. For globally diversified investors with material U.S. exposure, this has translated into strong returns over the past 10 years. That is a good thing in anyone’s book.

This relatively short time frame, particularly when measured against the long investment horizons of most investors, has led some to proclaim a new era of ‘US exceptionalism.’ This term refers to the belief that U.S. economic and corporate fundamentals are uniquely strong and enduring relative to other markets. However, some observers appear to have short memories. U.S. equity market performance in the 2000s, often referred to as the ‘lost decade,’ was anything but exceptional following the collapse of the dot-com bubble.

In hindsight, many might wish they had allocated more to U.S. stocks in the last 15-years or so. But, without the benefit of foresight, it’s impossible to predict whether this period of exceptionalism will continue - and if so, for how long.

Figure 1: Recent ‘exceptionalism’ vs. not-too-distant ‘unexceptionalism’ | Data source: Fama/French indices © All rights reserved. Dimensional Returns web. In GBP terms. 2020s to end Q1 2025.

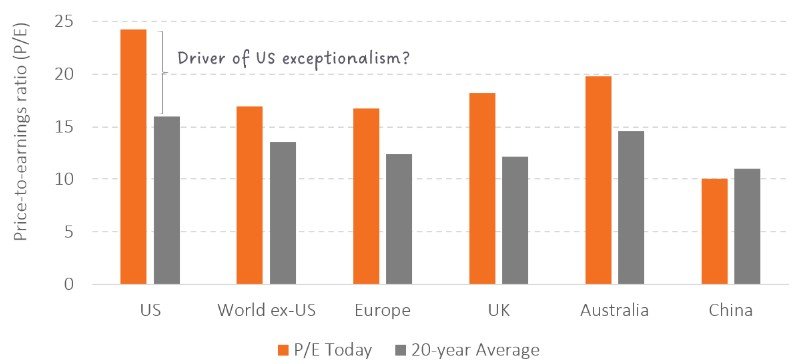

From an investor’s perspective, this notion of exceptionalism is visible in two key metrics: earnings forecasts and the price investors are willing to pay for each dollar of those earnings, as measured by the price-to-earnings (P/E) ratio. U.S. companies, particularly in sectors like technology, have consistently reported strong earnings - often outpacing their global counterparts. Investors have rewarded that consistency with rising valuations, as evidenced by high and growing P/E ratios. This steady upward drift in valuation may reflect more than just confidence in future profits. It may also suggest a deeper, perhaps implicit, structural faith in the U.S. economy itself. Whether this faith is justified - or illusory - is difficult to discern.

Figure 2: P/E Ratios Today vs. 20-Year Average (to 27/3/2025) | Source: Major Stock Index PE Ratios accessed on 28th May 2025.

Will US exceptionalism continue?

Looking ahead, several significant factors could challenge the sustainability of U.S. market dominance. Geopolitical tensions are intensifying. A potential return to American isolationism - particularly under a second Trump administration - raises uncertainties. On the fiscal side, ballooning deficits and a national debt now exceeding $37 trillion present additional risks. Competition in AI, chip making, EVs from China and elsewhere are material threats too. Meanwhile, the global financial system’s reliance on the U.S. dollar as its reserve currency could eventually be tested.

Although no credible alternative to the dollar currently exists, the so-called ‘exorbitant privilege’ it confers remains critical. This term refers to the unique benefits the U.S. enjoys due to the dollar’s dominance. This status helps suppress interest rates, lowers corporate funding costs, and attracts continuous inflows of foreign capital into American financial markets. However, even this privilege is not immune to global shifts or strategic challenges from other nations.

Believe it or not?

The future remains highly uncertain, with many plausible scenarios and a wide range of views about which are most likely. Fortunately, for individual investors who trust that markets are broadly efficient, we can rely on the collective intelligence of the market for guidance. It processes this vast, complex web of scenarios, risks, and probabilities, and distils them into a single figure: the price of each stock and, in aggregate, the market itself.

As a result, sensible investors are afforded their own version of an ‘exorbitant privilege.’ Rather than trying to predict whether U.S. exceptionalism will continue, we can take a neutral stance - neither moving overweight nor underweight U.S. equities based on short-term narratives. This neutrality reflects the collective wisdom and aggregate expectations of all market participants.

Ultimately, by avoiding market timing - a strategy with a poor track record according to substantial academic evidence - and remaining diversified through well-structured, low-cost systematic funds, investors increase their odds of achieving strong outcomes. This disciplined approach may offer a form of personal ‘return exceptionalism,’ quietly outperforming many active, judgment-based strategies over the long run.

If you have any questions about anything contained in this article or have concerns about your own portfolio then feel free to get in touch via the link below.

[1] https://siblisresearch.com/data/us-stock-market-value/ accessed on 28th May 2025

[2] ‘Mag 7 Gravity’, By Wes Crill, PhD, Kevin Green, PhD 01 April 2025 see www.dimensional.com accessed on 28th May 2025