Donut Buy the Meme Hype

Lately, investors may be having flashbacks to the early days of meme investing. Newly labeled meme stocks like Krispy Kreme (DNUT) have joined the meme menu with members of the original stack, including GameStop (GME) and AMC Entertainment (AMC).

But before investors consider loading up their portfolios with DNUT or any other meme stock, remember that chasing them is just another form of stock picking and market timing. History suggests such tactics rarely pay off: Those who try to pick winners generally lose to the broad market.

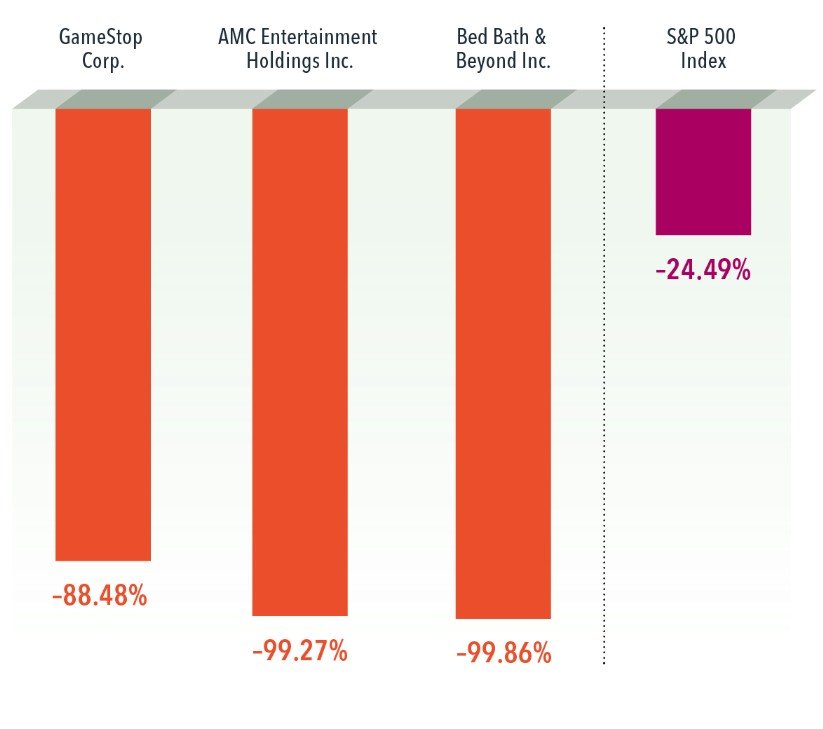

Single stocks—meme or otherwise—have a wide range of returns and on average underperform the broad market. Examining how meme stocks have fared since the phenomenon began can provide a reminder to investors to take caution. Many meme stocks have experienced extreme volatility: GME, for example, saw eye-wateringly high returns in early 2021 before falling sharply. Some, like Bed, Bath, and Beyond (BBBY), don’t even exist anymore.

By holding a diversified portfolio, investors often get exposure to meme stocks, while being more likely to capture market returns and limit individual stock risk. Stocking up on just one thing—whether it’s donuts or stocks with buzzy appeal—is not a reliable strategy for long-term satisfaction. But a well-balanced portfolio will often include a few meme stocks, which, like donuts, are best enjoyed in moderation.

Meme Stocks of 2021

Max drawdown, January 1, 2021–July 31, 2025