The patience premium

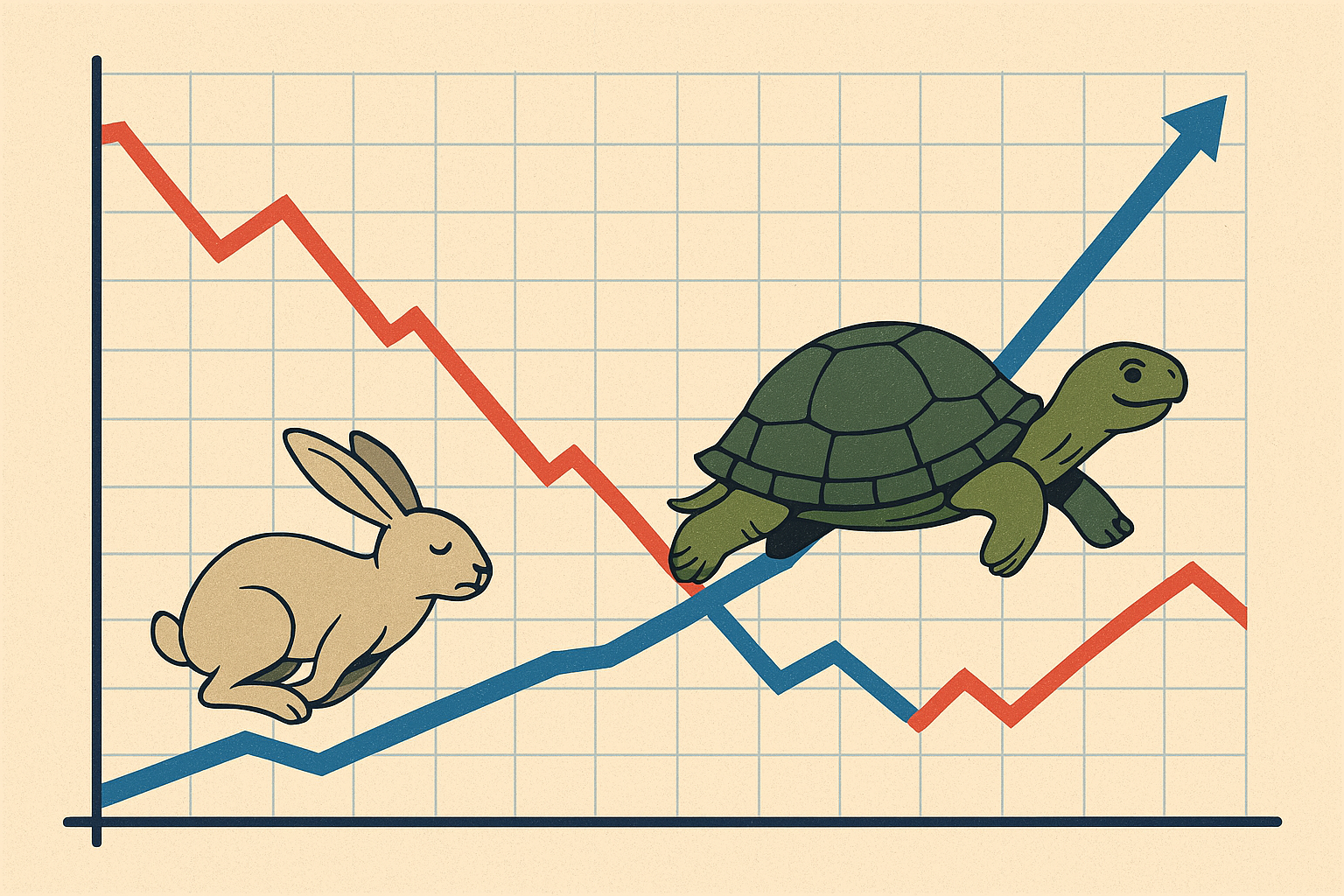

Investing is often framed as a numbers game - ratios, returns, and risk metrics. But beneath the surface lies something more human: behaviour. How we respond to market movements, uncertainty, and the passage of time can shape our experience far more than the structure of our portfolios - although, robust portfolio structure is still a key component of a successful outcome. This short note looks at the investor journey, and how time and temperament combine to influence outcomes.

The chart below highlights the percentage of time investors experienced above inflation returns in a simple portfolio mix of 60% global stock markets and 40% short-dated government bonds in recent decades. The results are illuminating, if unsurprising. On a daily basis, the odds of a positive outcome were little better than a coin toss - just over 50%. Monthly, it improved to 60%. As one extends the timeframe, the chances of seeing a positive real (i.e., above inflation) outcome improves. By 15 years, all returns comfortably outpaced inflation from the simple portfolio mix, with even the worst 15-year period improving investors purchasing power by 20%.

Figure 1: Investment outcomes tend to improve over time | Source: for simple portfolio mix see endnote. Bank of England. Inflation: UK CPI. 03/07/90-15/08/25.

The longer the horizon, the greater the likelihood of a positive outcome. Investors who check their portfolios daily are exposed to frequent disappointment. Those who look less often, and stay the course, experience a smoother journey.

To demonstrate this point, we compared two investor experiences: one who checks their portfolio daily, and another who checks only once every three years, on 1st July. While the latter is clearly extreme and not necessarily practical, it powerfully illustrates how moderating one’s behaviour can transform the emotional experience of investing. The daily view is noisy and often unsettling, while the three-yearly snapshot is calmer and more consistently positive. Same portfolio, same returns - yet the emotional journey is vastly different. This reinforces a key behavioural truth: how often you look affects how you feel, and how you feel can influence what you do.

Figure 2: How often you look affects how you feel | Source: for simple portfolio mix see endnote. Bank of England. Inflation: UK CPI. 03/07/90-15/08/25. Log scale.

In today’s tech-driven, social media-based society, this challenge is amplified. We live in a world of instant updates, clickbait headlines, and powerful attention-seeking algorithms designed to keep us engaged, reactive, and emotionally charged. We can all take out our phones right now and get an up-to-date stock market valuation. But what are we really reacting to? Noise. The temptation to act - especially in response to short-term volatility - is ever-present.

While portfolio structure remains vital, behaviour is the bridge between strategy and success. Our role as your adviser is to help you stay focused on what matters: long-term goals, disciplined strategy, and thoughtful oversight. We monitor the evidence, challenge assumptions, and ensure your investment journey is aligned with your financial plan.

If you found this article interesting and would like to learn more about successful investing then please feel free to get in touch via the link below.