Recent movements in the US dollar

Recent headlines have drawn attention to the fall in the US dollar, raising questions among investors and market watchers alike. At this stage, the recent decline is comparatively modest, at least in a historical context. The US dollar has seen several periods of both relative strength and weakness over the past five decades. Currency movements are nothing new.

Figure 1: US dollar versus basket of global currencies, Jan-75 to Jun-25

Data source: Bank for International Settlements (2025), Effective exchange rates, BIS WS_EER 1.0 (data set), https://data.bis.org/topics/EER/data (accessed on 06 August 2025). Nominal US exchange rate versus narrow currency basket, monthly.

Unpredictability of US dollar movements

It is important to remember that currency movements are notoriously difficult to predict. The value of the dollar is influenced by a multitude of factors including interest rate differentials, monetary policy, geopolitical events, and relative economic growth, to name some examples. This is not to say that movements in the US dollar are unimportant or won’t affect stock markets, but rather predicting the direction and impact of currency fluctuations is a fruitless task.

Despite sophisticated economic models and vast amounts of market analysis, predicting the short- or medium-term direction of the dollar has consistently proven to be unreliable. Most currency strategies are beaten by those simply following a random walk[1].

US dollar versus stock markets

A misconception is that movements in the US dollar has a direct and predictable impact on the direction of global stock markets. In practice, the data suggest otherwise. As an investor in the UK over the past 50 years, the long-term correlation between the US dollar and global equity returns has been close to zero[2] - a rising/falling dollar does not translate into a consistent pattern of a rising/falling stock market.

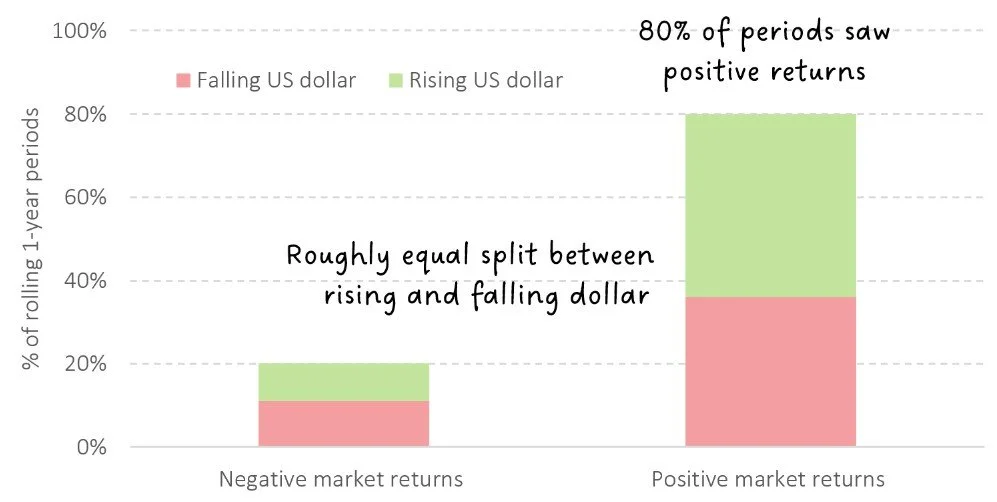

For instance, there have been many periods when both the dollar and global stocks have risen together, as well as times when both have fallen, or moved in opposite directions. Analysis shows that when the stock market is rising, the US dollar is nearly as likely to rise as it is to fall. The same is true when the stock market is falling. One thing that is clear from the figure below is markets tend to go up more than they go down. 4-in-5 years based on the data used here.

Figure 2: US dollar in rising/falling stock markets, 1y monthly rolling, Jan-75 to Jun-25

Data source: Bank for International Settlements (2025), Effective exchange rates, BIS WS_EER 1.0 (data set), https://data.bis.org/topics/EER/data (accessed on 06 August 2025). Nominal US exchange rate versus narrow currency basket, monthly. Albion World Stock Market Index (in GBP) (see smartersuccess.net/indices for more information).

Conclusion

Whilst currency movements can capture attention and sometimes create noise in investment markets, it is crucial to maintain discipline and not make knee jerk decisions in an investment portfolio. Understanding the true impact of global currency movements on stock market performance on an historical basis is a difficult task – to do so on a forward-looking basis is perhaps impossible.

Stick with the program. Focus on what can be controlled (e.g. have deep understanding of the risks adopted, monitor costs closely, incorporate a rigorous governance process). This is the role of our Investment Committee, ensuring your portfolio stands the best chance of weathering whatever storms lie ahead and enable you to achieve your financial goals with maximum confidence.

If you would like to explore this subject in more depth or wish to understand the impact currency movements have on your portfolio please feel free to get in touch via the link below.

References

[1] E.g. Moosa, I. (2013). Why is it so difficult to outperform the random walk in exchange rate forecasting? Applied Economics, 45(23), 3340–3346. https://doi.org/10.1080/00036846.2012.709605

[2] Nominal US exchange rate versus Albion World Stock Market Index (in GBP) (see smartersuccess.net/indices for more information). Monthly terms.